do nonprofits pay taxes on rental income

Do nonprofits pay payroll taxes. The answer to this question is YES.

Beginner S Guide To Rental Income For Non Profits Taxable Or Not Blue Co Llc

Enjoy flat rates with no-surprises.

. In addition many nonprofits are also exempt from paying sales tax on purchases made. June 30 2021. Did you know that sometimes nonprofits must pay income tax.

Rental Property as Investment. This means the rental income investment income and many other forms of income that would be tax exempt for other organizations are not tax exempt for 501c7 9 and 17 organizations unless the income is derived from activities substantially related to the exempt purpose. Rental income works just about the same way as any other type of income.

Your recognition as a 501c3 organization exempts you from federal income tax. Most individuals use the cash basis method Most individuals use the cash basis method This method requires you to report income as. However this corporate status does not automatically grant exemption from federal income tax.

Just because you have a tax-exempt status it does not mean that youre well tax exempt. While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry.

The rental income you declare on your income taxes will depend on your method of accounting. There are two ways to pay tax. You generally deduct your rental expenses in the year you pay them.

Yes nonprofits must pay federal and state payroll taxes. While most US. There are clear rules as well as several exceptions to.

To be tax exempt most organizations must apply for recognition of exemption from the Internal Revenue Service to. Some nonprofits are tax exempt meaning they do not have to pay federal corporate income tax. We never bill hourly unlike brick-and-mortar CPAs.

When the IRS reclassifies rentals as not-for-profits the rental income and expenses must be reported differently than ordinary rentals resulting in a. The main reason for this is that nonprofits are exempt from paying federal income taxes and as a result may also be exempt from paying state and local taxes as well. If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption.

In general those who rent out a property for 15 days or more out of the year must pay taxes on rental income. But if you rent out a property for only 14 days or fewer out of the year you dont need to pay or report taxes on rental income. Tax-exempt organizations also known as 501 c 3 organizations can have Unrelated Business Taxable Income UBTI when the organization has revenue streams outside of its direct charitable purpose.

Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. Do I have to pay taxes if I work for a nonprofit. Rental Income and UBTI A Look at the IRS Guidance to Its Auditors.

Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types of taxes under certain circumstances. The IRS incorporated into the tax codes something called Unrelated Business Income UBI and its especially for nonprofit organizations. The income you earn by working for a.

Generally speaking rents from real property are excluded from UBTI. But determining what are an organizations exempt purposes is not always as clear as one might think and distinguishing between related and unrelated activities can be tricky. Or maybe you received a payment for indoor tanning services you providedyoud have to pay taxes on this income quarterly.

Nonprofits are not required to pay personal property taxes though some do choose to do so. Report rental income on your return for the year you. Depending on the circumstances the rental income might be considered unrelated business income a taxable income category for nonprofits.

Note that each one of these factors requires further research to determine if any taxes apply. In most cases when they are taxed nonprofits must pay the unrelated business income tax UBIT on income not substantially related to furthering the organizations exempt. But nonprofits still have to pay employment taxes on behalf of their employees and withhold payroll taxes in accordance with the information submitted on their W4 just like any other.

Income Taxes Exempt nonprofits generally do not have to pay taxes on their incomes but some types of income are taxable.

Follow Mikamu Consultant S Mikamuconsulta1 Latest Tweets Twitter

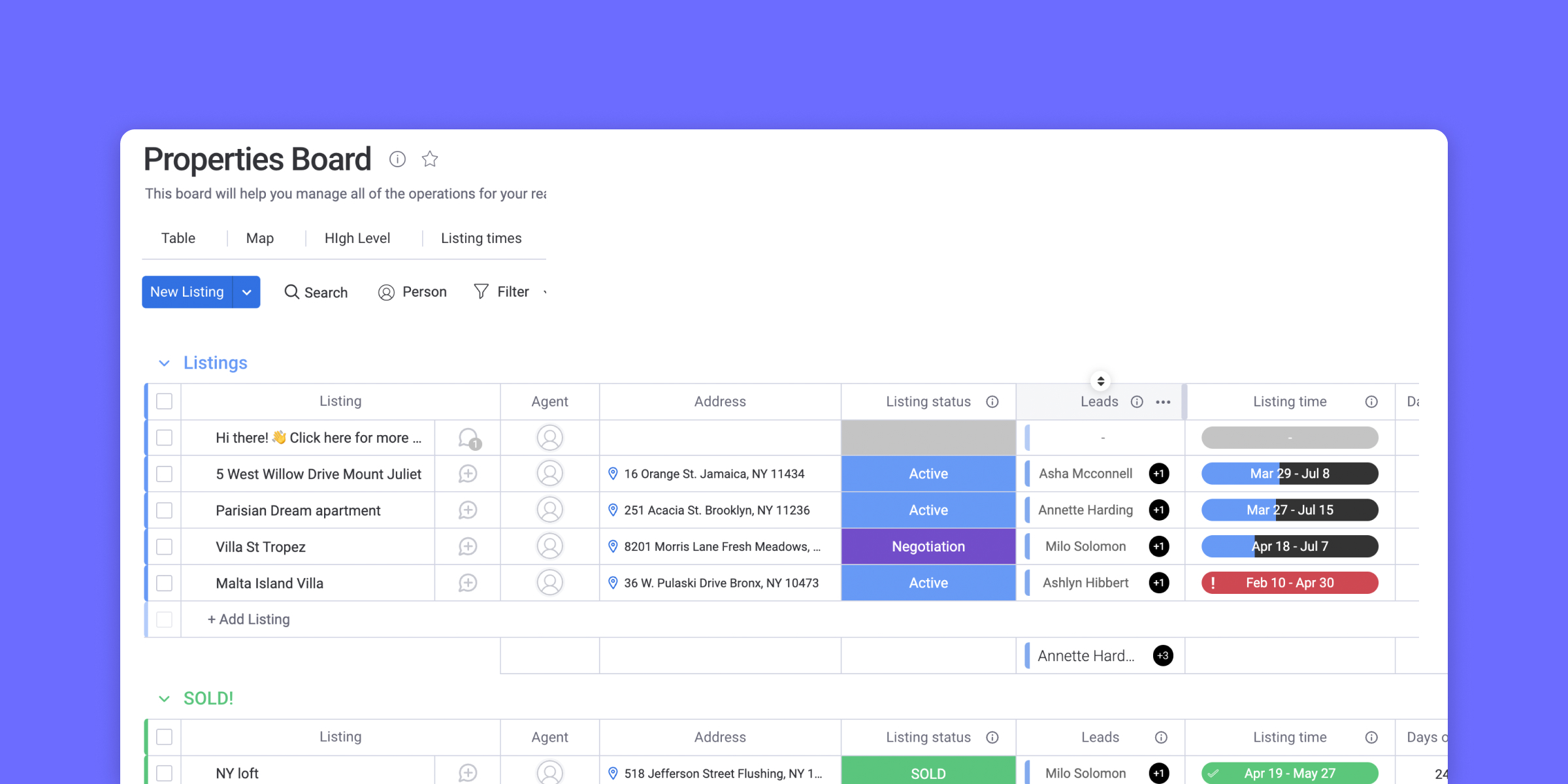

Best Rental Property Spreadsheet Template For Download Monday Com Blog

Calculation Of Income From House Property How To Save Tax On Rental Income In India Rental Income Tax Deductions Income

Tax Tips For Rental Properties Bhhs Goodtoknow Bh Mke Com Real Estate Investing Rental Property Rental Property Management Rental Property Investment

Renting Out Your Home Don T Worry There Are Still Ways You Can Deduct Some Of The Expenses From Your Being A Landlord Rental Property Management House Rental

Free Cash Flow Forecast Templates Smartsheet Cash Flow Smartsheet Free Cash

15 Property Tracking Expense And Rental Income Tracking Etsy Being A Landlord Rental Property Management Rental Property

Tax Information Nonprofits Renting Extra Space Church Facility Solutions

Best Rental Property Spreadsheet Template For Download Monday Com Blog

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

How To Calculate Rental Property Cash Flow A Comprehensive Guide Rental Property Real Estate Investing Rental Property Rental Property Investment

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

Best Rental Property Spreadsheet Template For Download Monday Com Blog

Airbnb Rental Income Statement Tracker Monthly Annual Etsy Airbnb Rentals Rental Income Rental Property Management

How To Make Your Nonprofit Facebook Page Great In Under Five Hours